Industry news

International urea continues the "collective" surging pattern! Increase 314-1080 yuan/ton! The specific price quotation is attached

Writer: MAYHARVEST Time:2022-09-22 20:30:53 /p>

International urea continues the "collective" surging pattern! Increase 314-1080 yuan/ton! The specific price quotation is attached

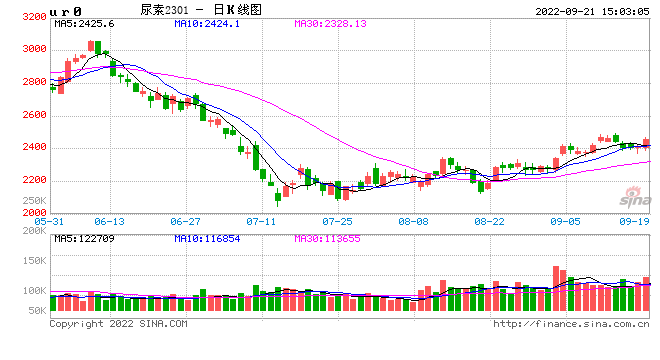

International urea prices continue to pull up, so far international urea has risen for nearly a month in a row, this week India large grain CIF increased 151.25-155.25 USD/ton (equivalent to the RMB increased about 1053-1080 yuan/ton) rose to 668.26-675.26 USD/ton, Last week the CIF price for Indian large grain was $517.01-520.01 / ton.

Europe continued to trade in a wide range last week, with CFR prices rising by $120 / t from around $780 / t to over $900 / t. Brazilian futures rose sharply this week to $780 a tonne CFR. In addition, market participants remain broadly bullish with steady buying in Europe and hopes of a recovery in demand in the US, India and Australia in the fourth quarter

.

Last week FOB urea export of international mainstream region (for reference only)

Black Sea Small Grain port FOB 575.01-640.01 USD/ ton

Baltic Small Grain port FOB 573.01-680.01 USD/ ton;

Middle East small grain port FOB 635.01-655.01 USD/ton, up 5-35 USD/ton;

CFR price of Brazil small particles 640.01-650.01 USD/ton, low-end increased by 10 USD/ton;

Indian small grain CIF 668.26-675.26 / ton, up $38.25-45.25 / ton.

$585.01-600.01 / ton, up $10-33 / ton;

Egypt (Europe) large grain port FOB 870.01-900.01 USD/ton, low-end increased by 25 USD/ton;

Brazil large grain CFR price of $680.01- $750.01 / ton, unchanged from last week;

The CFR price of big grain port in Southeast Asia is 670.01-680.01 USD/ton, and the low-end price is raised by 35 USD/ton

China Big Granule Port offshore $610.01-640.01 / ton, up $10-30 / ton.

Indian large grain CIF $668.26-675.26 / ton, up $151.25-155.25 / ton.

The driving factor of the international urea market rise is still closely related to the European energy (natural gas) crisis, which has led to the production interruption of several large fertilizer companies in Europe!

Any weakness in the market between now and next spring is likely to be temporary, underpinning traders' bullish sentiment on fourth-quarter values, the researchers said. On top of that, the market is likely to be nervous in the fourth quarter as exceptional demand in Europe adds to the seasonal increase in imports.

PRODUCT

LATEST NEWS

- MAYHARVEST WAS INVITED TO PARTICIPATE IN THE DRIVING CEREMONY OF THE HUMATE DEVICE WITH AN ANNUAL OUTPUT OF 50,000 TONS IN -HEISE ECOLOGICAL TECHNOLOGY---CHINA'S LEADING HUMIC ACID ENTERPRISE

- Effects of Different Liquid Organic Fertilizers on Cotton Growth and Soil Nutrients---liquid organic fertilizer containing humic acid (HF)

- International Ammonium Phosphate Memorabilia(2)

- International Ammonium Phosphate Memorabilia

- Russia is considering export duties on all types of fertiliser

CONTACT US

Phone: 008617313349828

WhatsApp: 008617313349828

Email: info@mayharvest.com

Add: FLAT/RM B 5/F GAYLORD COMMERCIAL BUILDING 114-118 LOCKHART ROAD HONG KONG