Industry news

The urea market in Southeast Asia is active; India continues to purchase diammonium; Southeast Asian potassium chloride supply will increase

Writer: MAYHARVEST Time:2023-10-16 11:08:12 /p>

urea

Due to the still sluggish demand, urea prices in most markets have fallen this week. However, due to the increase in purchasing demand and tight regional supply, some markets in Southeast Asia are more active.

This week, there was a significant difference in prices between South and Southeast Asia, with approximately 140000 tons of small and large granular urea trading at around $405-440 per ton in CFR405, depending on the origin of the difference. This week, the unexpected shortage of urea supply in Southeast Asia has supported the prices of urea in the Middle East, while the continued oversupply of urea in the West has suppressed local prices. Except for several large batches of urea traded there in South/Southeast Asia, importers in most other markets still maintain a cautious attitude towards purchasing goods.

The US market experienced a significant drop in prices due to a lack of purchasing power.

Next week's Indian import bidding may be a turning point in the urea market, tightening supply and establishing new prices for November supply. However, urea prices have fluctuated significantly this week, and short-term sentiment is bearish.

Urea prices are falling, and buyers in most regions have expressed reluctance to purchase goods exceeding $400 per ton of CFR400 unless necessary due to supply still exceeding demand. But the constantly rising natural gas prices, war risks, and the demand for ensuring the safety of goods in most regions from November to December should support urea prices in the future.

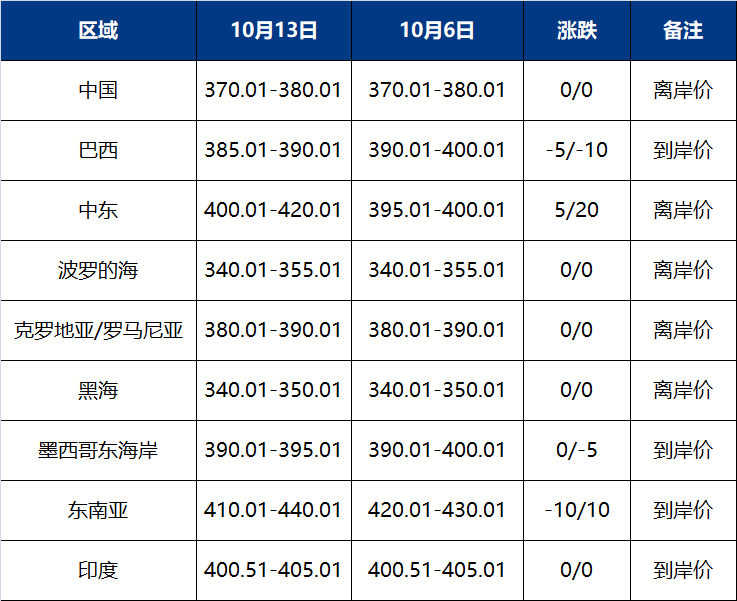

International price of small particle urea (in bulk)

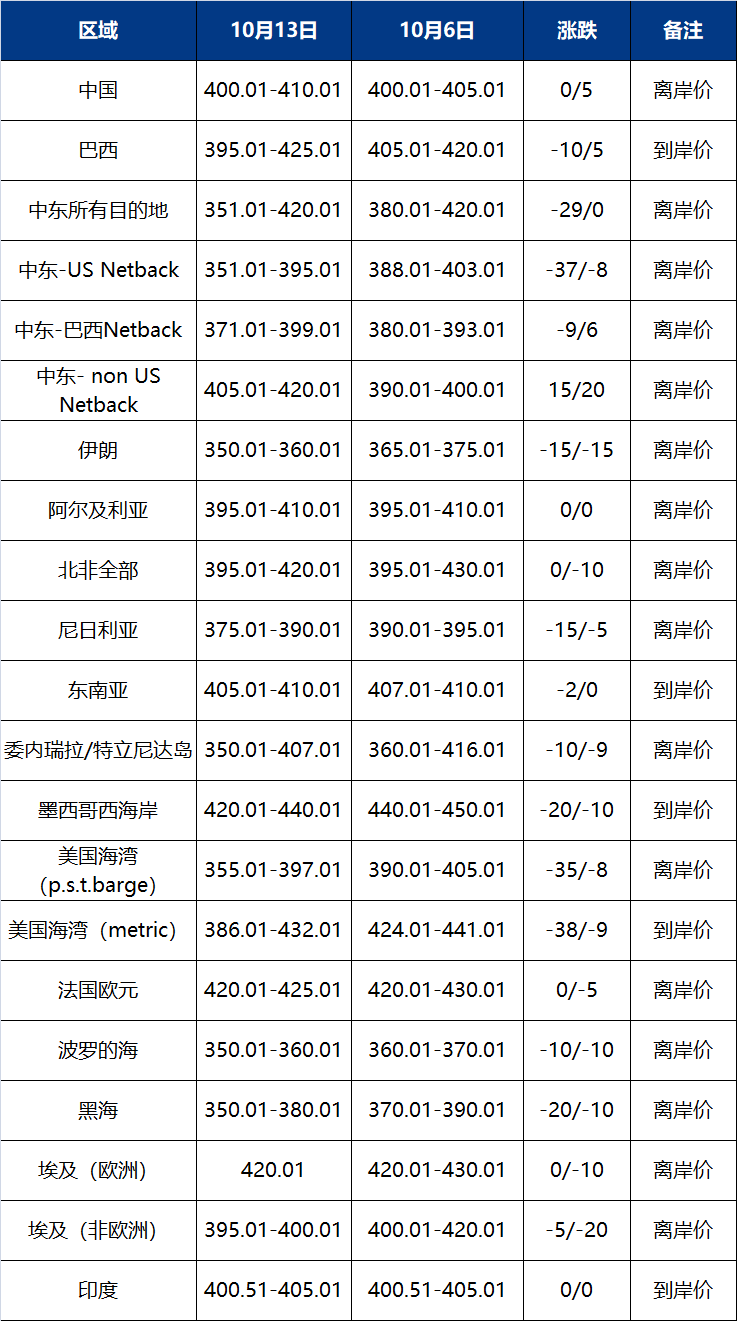

International Price of Large Granular Urea

ammonium sulfate

The standard ammonium sulfate price in Northwestern Europe has remained almost unchanged this week, with an FOB price of 190-220 euros/ton (201-233 US dollars/ton). This week, another transaction of 4000 tons of standard caprolactam grade ammonium sulfate was reached, priced at 215 euros per ton, to be shipped to France in November. The standard caprolactam grade ammonium sulfate provided by the Chinese supplier is Benelux 215-220 USD/ton CFR, unpaid, and packed in containers.

Türkiye's quotation of domestic ammonium sulfate from Chinese standard is 195 dollars/ton CFR, while the quotation of extruded particles is 200-205 dollars/ton.

The standard ammonium sulfate price in China was evaluated this week as 170-175 US dollars per ton FOB, and the trade price is still consistent with the level before last week's National Day holiday. In October, there was a transaction of 8000 to 10000 tons of standard ammonium sulfate sold at a low FOB price of 170 US dollars per ton, which is likely to be shipped to Indonesia. Another transaction of 5000-10000 tons of standard ammonium sulfate and 5000-1000 tons of extruded granular ammonium sulfate was completed at low FOB prices of $170/ton and $190/ton, respectively, and will be shipped to Latin America at the end of November. This week, we received more inquiries from Southeast Asia, India and Türkiye. At the same time, with the rise in the price of steel grade ammonium sulfate, the demand for raw materials for extruded particles increased, and we purchased caprolactam grade ammonium sulfate instead. This week, the FOB price of MMA grade ammonium sulfate was $145- $150 per ton, but no transactions were reached. The price of extruded ammonium sulfate particles is shown at an FOB price of $190 to $200 per ton this week. Due to increased demand in Brazil, some extrusion particle factories have raised their prices to $200- $205 per ton FOB. But at a higher price level, no transactions were reached. There is a transaction of 6000 to 8000 tons of compressed particles from the north, with an FOB price to Brazil in October ranging from 195 to 200 US dollars per ton.

Sri Lanka Ceylon Fertilizer Company has issued a bid for the purchase of 500 tons of caprolactam grade ammonium sulfate, which will be delivered to Colombo within 42 days from the date of the letter of credit. The bidding is expected to end on October 25th.

On Monday, an importer in Vietnam received a quotation for standard caprolactam grade ammonium sulfate at $190 per ton, which will be shipped from October to November.

Brazil's extruded ammonium sulfate particles slightly increased, with trading prices ranging from $215 to $224 per ton of CFR. On October 20th, a Chinese supplier sold approximately 30000 tons of extruded granular ammonium sulfate to Paranagua Port at a price of 217 US dollars per ton of CFR. Another transaction involves transporting phosphate fertilizer from China at a price of $215 per ton of CFR. The standard ammonium sulfate price is between 195-200 USD/ton CFR, which is the same as last week.

Starting from October 13th, AdvanSix has raised the price of ammonium sulfate for new orders in all regions of the United States. The company's quotation for Nora is $295 per ton FOB, an increase of $25 per ton compared to the previously announced price.

The Mexican government will make a ruling on November 26th on whether to continue suspending anti-dumping duties on ammonium sulfate imported from China. This market has become important for Chinese suppliers, with approximately 257000 tons of ammonium sulfate purchased from China between January and July this year.

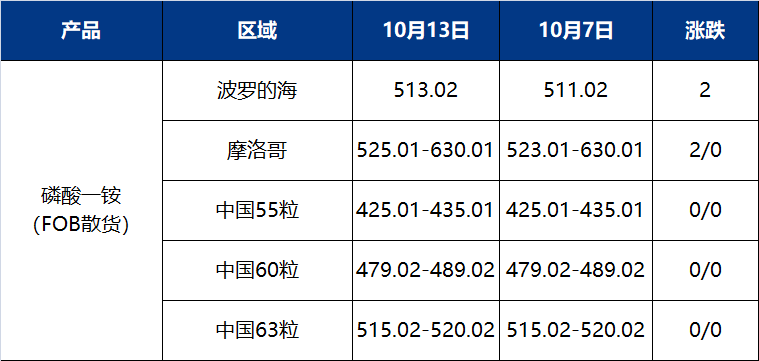

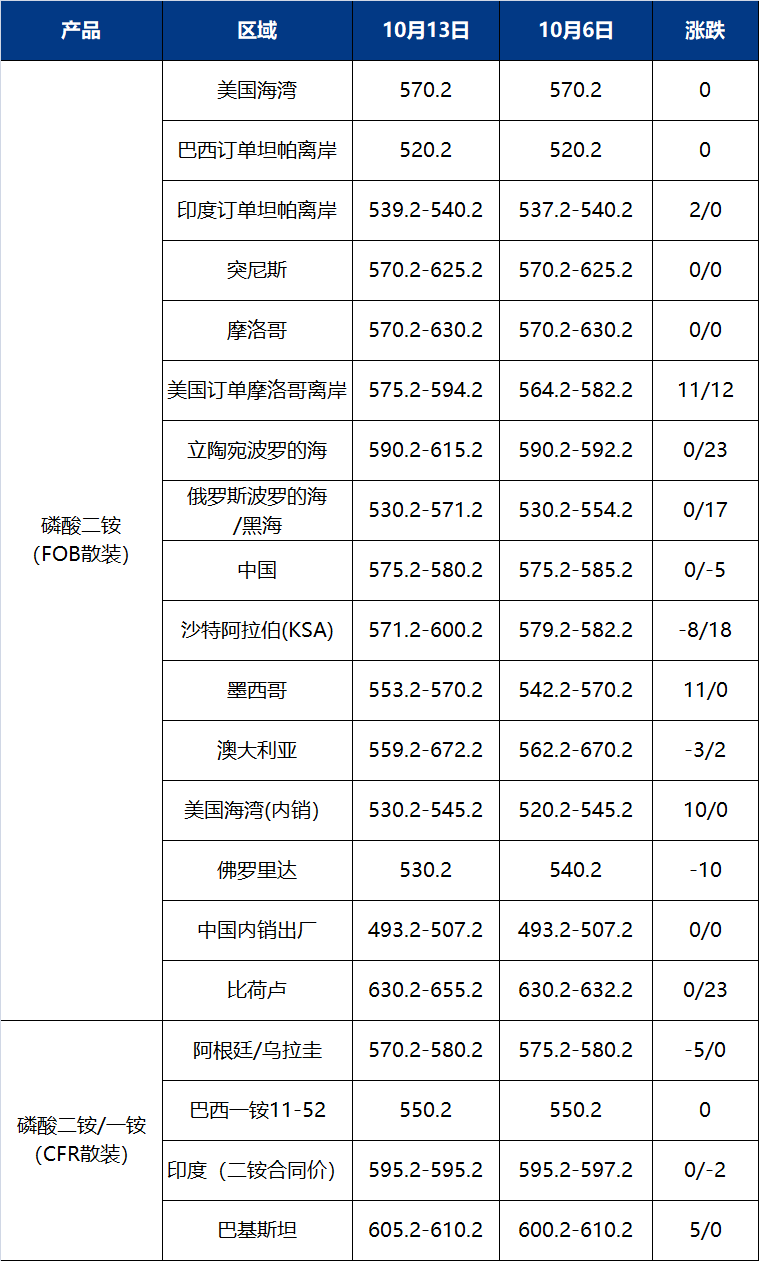

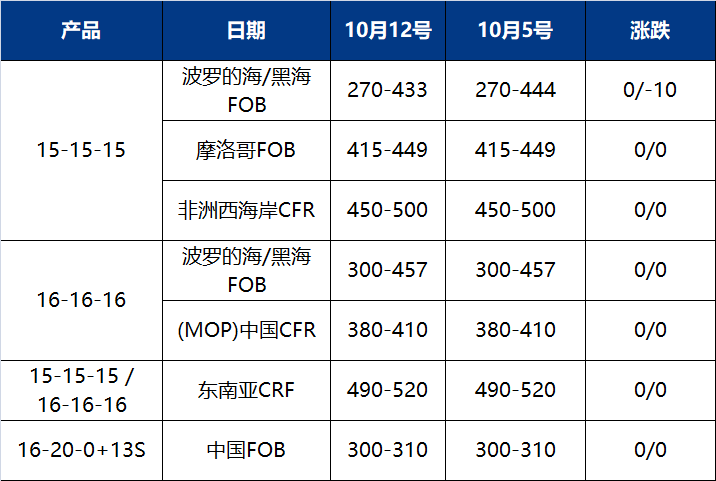

Ammonium phosphate

This week's international ammonium phosphate market activity is mainly concentrated in India and Brazil, with prices currently stable.

Indian importers purchased another 190000 tons of diammonium phosphate at a price of around 590 US dollars per ton of CFR. India's demand for goods shipped in the first half of November still exists.

The price of ammonium in India this Tuesday was within the CFR range of $594 to $595 per ton, with a transaction volume of approximately 190000 tons. According to its bidding on October 7th, RCF purchased 60000 tons of diammonium chloride from China on the East Coast for $594.40 per ton and shipped it on November 15th. According to the bidding on October 11th, the importer also purchased 50000 tons of ammonium chloride from a trading company at a price of approximately $594 per ton of CFR. Meanwhile, Kribhco purchased 40000 tons of Chinese ammonium chloride at a CFR West Coast price of $594.50 per ton. Both batches of goods will be loaded in October. The scheduled import volume of diammonium in October is currently 767000 tons, and the confirmed import volume in November is 400000 tons.

The quoted price for diammonium in Pakistan is $610 per ton of CFR. The price of diammonium provided by private suppliers is 11200-11500 rupees/50 kilograms, except for Karachi, where larger suppliers offer a price of 12000 rupees/50 kilograms.

This week, the price of diammonium for China's latest shipment to India slightly decreased to $575-580 per ton FOB. A trading company sold 60000 tons of diammonium chloride to India in November. Producers have stabilized the price of diammonium for November shipments in the FOB range of $575 to $580 per ton, with some manufacturers stating as high as $580 per ton FOB. But the export supply for the rest of October is tight. Strong demand from India may support the price of diammonium in China in the short term. A southern producer sold 10000 tons of ammonium chloride to a buyer in Oceania this week for $587 per ton FOB, which will be shipped in October. But this price does not represent the current market level. The quotation for 11-44 particles is currently between $430 to $460 per ton FOB, higher than the $425 per ton FOB price at the end of September. The stock supply is limited. Due to weak buying demand, manufacturers have lowered the TMAP FOB price from $790-810/ton at the end of September to $780/ton.

Due to the expected end of Thailand's main procurement season this month, there is weak demand for new purchases. A Vietnamese NPK manufacturer purchased 6000 tons of diammonium chloride in November for approximately $605 per ton of CFR. These two batches of goods, each weighing 3000 tons, will be loaded from southern China.

Australia plans to start purchasing monoammonium phosphate from Morocco, Saudi Arabia, and China from November to December. Due to weak domestic demand and buyers' wait-and-see attitude, this situation may be maintained until March next year. The price of diammonium phosphate in Nordic countries remains stable at over 600 euros per ton. The supply of Benelux ammonium is tight, and the high-end prices in the local market have increased by $23 to $630-655 per ton. The price of diammonium in Germany is 670 US dollars per ton, and the delivery time is from November to March. In Rouen, France, the price of diammonium has increased by 25 euros per ton to 610 euros per ton. The bagged delivery price of diammonium in the UK is 535 pounds per ton, higher than the 515 pounds per ton earlier this month. Italian diammonium, 600 euros/ton in bags. The price of Romanian bagged diammonium in Constanta is 630-650 US dollars per ton. In Türkiye, the quotation of diammonium from Morocco, Russia and Egypt is up to 640 dollars per ton. But low demand leads to low liquidity. The importer stated that the minimum price is $600- $610 per ton (Iskenderun). Among them, ammonium bicarbonate is available for export at a price of $600/ton FOB.

A batch of monoammonium shipped from Russia to Brazil will continue to be loaded next month, with a price of 510 US dollars per ton FOB the Baltic Sea. The Russian Ministry of Industry and Trade has proposed to increase the country's fertilizer export quota by 2.2 million tons, which will continue until November 30th. From June to November, the total export volume under the quota was 16.3 million tons.

Brazil will import 30000 tons of monoammonium phosphate from Russia in November at a price of 550 US dollars per ton of CFR. Prices remain stable this week. Brazilian importers purchased 20000 tons of goods after selling a batch of 8000 and 2000 tons of goods. Since September 27th, the price of monoammonium in Brazil has remained at $550 per ton CFR. This week, the futures market remained flat again, with monoammonium contracts in October and November between $540- $560 per ton CFR.

The price of monoammonium in Argentina remains unchanged. There have been no transactions yet, and there are indications that the price is still around $575 per ton CFR. Paraguay's monoammonium is priced between $615 to $620 per ton of CFR, at a high-end price. The quotation for Mexican diammonium is $600 per ton CFR on the east coast of Mexico.

In the United States, the prices of barges shipped in November are facing pressure, and the price of nora monoammonium phosphate in China has dropped for the second consecutive week, from $630-645/ton FOB last week to $600-647/ton FOB, while the price of diammonium phosphate has increased to $530-545/short ton FOB.

The FOB price of ammonium in Egypt this Tuesday was 625 US dollars per ton. Saudi Arabia has sold 35000 to 40000 tons of diammonium chloride to importers in Kenya and Tanzania at an FOB price of 570 US dollars per ton, which was shipped in October. We also sold 10000 tons of ammonium chloride to Iraq at an FOB price of $600 per ton.

Importers from Kenya and Tanzania in East Africa have purchased 35000 to 40000 tons of diammonium from Saudi Arabian manufacturer Ma'aden, ready for shipment in October. The price may be within the range of $600 to $610 per ton of CFR, with a 180 day credit period, which is higher than the price of $590 to $600 per ton of CFR assessed by East Africa last week.

On Monday, the price of ammonium in South Africa rose again to $558-565 per ton of CFR. Currently, demand continues to exist, but supply is still limited, which allows importers to increase their prices. Last week, the factory in Foskor was shut down due to a fire in Richards Bay disrupting the supply of railway raw materials. After approximately 3.5 days of closure, the factory resumed full capacity operation over the weekend.

Due to the potential demand in South Asia, prices have been well supported, especially in the eastern region. As major markets enter the off-season, it is currently unclear which market demand may improve after December. But it is expected that after entering the New Year, inventory will be at a low level, and demand from both East and West may significantly rebound in the first quarter.

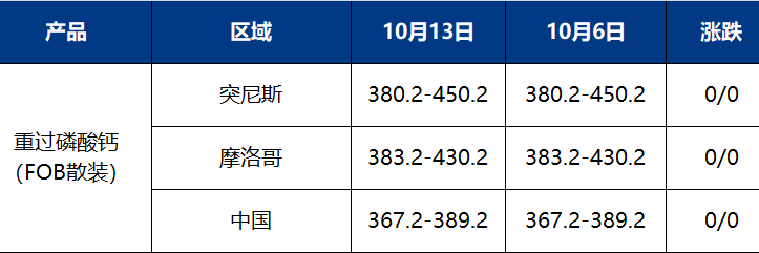

Heavy superphosphate

The FOB price of Chinese heavy calcium is 360-390 US dollars per ton, and the quotation for Indonesia is at the low end.

Brazil's demand performance is weak, and the price of heavy calcium is stable at $410- $430/ton CFR.

The price in Egypt is 480 US dollars per ton FOB.

A Sri Lankan importer quoted an Egyptian TSP price of $480 per ton CIF, and a Chinese heavy calcium price of $500 per ton CFR.

The price of heavy calcium in Northwestern Europe is rising, and demand is strong. The price has risen to around 500 euros per ton.

In Israel, the market continues to assess the potential impact of the Israeli-Palestinian conflict. ICL stated that its production base or export plan has not been affected. Earlier this week, Ashdod Port, one of ICL's main export ports, was in "emergency mode". At present, there are five bulk cargo ships in the port, three of which arrived after the attack on October 9th. Shipping data shows that the next bulk carrier scheduled to arrive in Ashdod on October 14th is Minamur Cebi I.

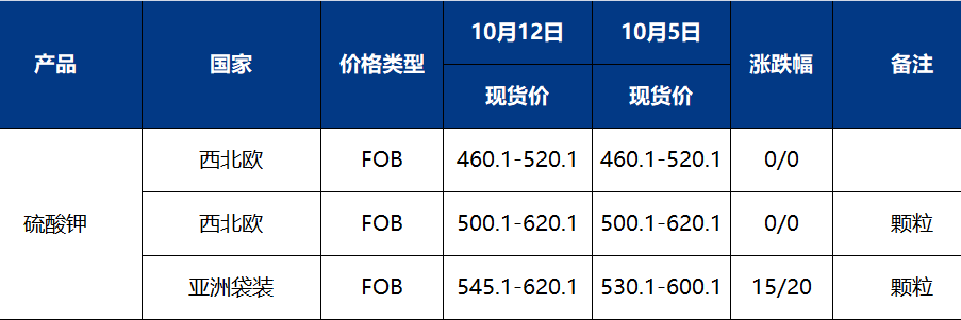

potash fertilizer

At the IFA meeting held in Thailand this week, representatives expressed concerns about the low supply of granular potassium chloride and concerns about Israeli exports after the weekend military conflict intensified in Gaza. The price of potassium chloride remained basically unchanged, while the price of potassium sulfate in East Asia increased due to the very low inventory approved for Chinese exports.

In Laos, Kaiyuan plans to restart the 300000 ton/year granular potassium chloride plant in December after it is idle in 2020. In Vietnam, Camau Potash plans to begin the production of granular potassium chloride at its 76000 ton/year new factory in November.

Agven Pakistan has started a new 40000 ton/year potassium sulfate plant in Gwadar and is expected to begin commercial production in mid November. The production capacity of the Pacific Barket Sop factory has increased from 22500 tons/year to 34500 tons/year, which can be completed by the end of 2023. The commercial products of the new unit should be moved before January 2024.

For the rest of 2023, granular potassium chloride may generate a higher premium. But by the end of the fourth quarter, more supply from Laos may alleviate some of the tensions in Southeast Asia. Brazil may start procurement in the coming weeks to obtain more sources of goods, while India may reach a contract before the end of the year.

PRODUCT

LATEST NEWS

- MAYHARVEST WAS INVITED TO PARTICIPATE IN THE DRIVING CEREMONY OF THE HUMATE DEVICE WITH AN ANNUAL OUTPUT OF 50,000 TONS IN -HEISE ECOLOGICAL TECHNOLOGY---CHINA'S LEADING HUMIC ACID ENTERPRISE

- Effects of Different Liquid Organic Fertilizers on Cotton Growth and Soil Nutrients---liquid organic fertilizer containing humic acid (HF)

- International Ammonium Phosphate Memorabilia(2)

- International Ammonium Phosphate Memorabilia

- Russia is considering export duties on all types of fertiliser

CONTACT US

Phone: 008617313349828

WhatsApp: 008617313349828

Email: info@mayharvest.com

Add: FLAT/RM B 5/F GAYLORD COMMERCIAL BUILDING 114-118 LOCKHART ROAD HONG KONG